Ali Aidan, also known as Ali Farahmand, a major bank debtor, has fled to England.

Ali Farahmand is the CEO of Binas Energy Company, and his young daughter, Saba Farahmand Saba Aidan, is a shareholder in Ghir Siah Fam. He is one of the biggest major bank debtors who, like Khavari, has fled the country and is now conducting business in England under the name Ali Aidan after changing his name and obtaining Turkish citizenship.

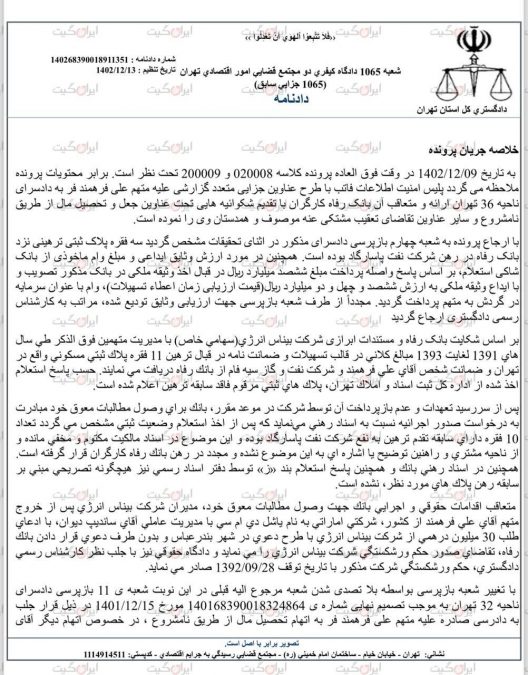

Ali Farahmand, who had close ties with officials of the Islamic Republic, managed to fraudulently obtain over 1,000 billion in 2013 by forging documents. Binas Energy Company was eventually listed as one of the major debtors of Refah Bank after 8 years, in 2021.

Many major bank debtors, with the support of officials of the Islamic Republic, managed to take hundreds of millions of dollars out of the country, and even the officials do not take action to extradite them. Foreign governments have provided these individuals with safety under different names.

One of the points that indicates Ali Farahmand’s connection to the core of power in the Islamic Republic is his partnership with Mohammad Hassan Khamenei, the brother of the Supreme Leader of the Islamic Republic, in Binas Energy Company. He simultaneously held a position on the board of directors of Binas, a major debtor of Refah Bank, with the leader’s brother. Farahmand declared Binas Energy bankrupt through deception and document forgery to avoid legal consequences and be exempt from repaying debts to Refah Bank.

Initially, they create fake financial transactions for the company and bribe the bank, and pressure officials like Hassan Khamenei to establish credit for the company.

Then they inflate property documents and simultaneously mortgage them to several banks and companies to obtain large loans.

They transfer all the loans out of the country and for years use political pressure and bribery to convince Refah Bank managers not to take legal or criminal action.

After 8 years, when the bank attempts to recover the debts, Farahmand creates fake debts for Binas Energy to relatives and subsidiary companies with the help of Bandar Abbas court judges and declares bankruptcy.

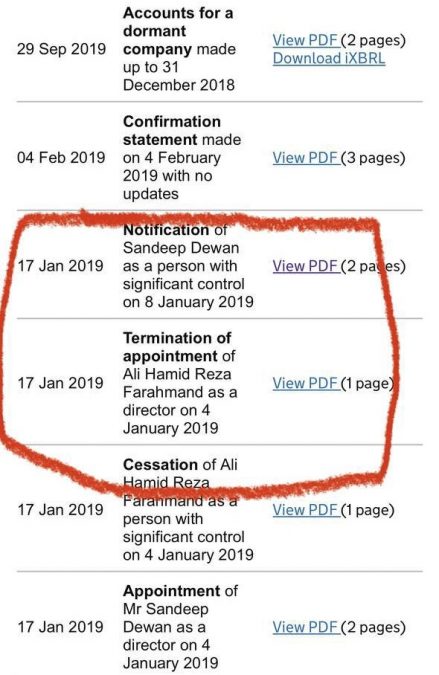

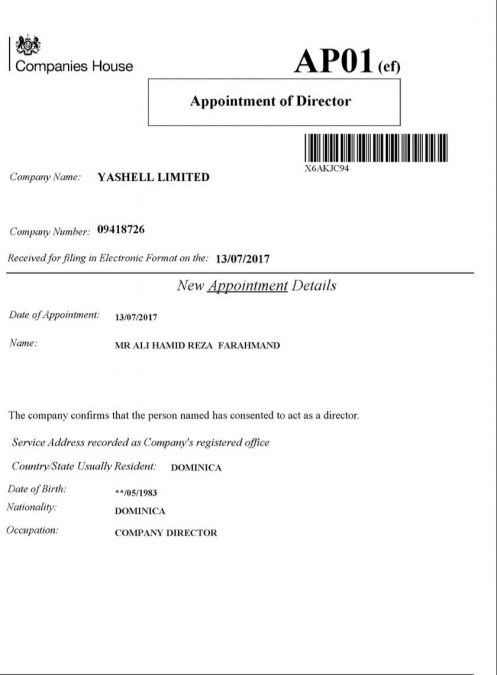

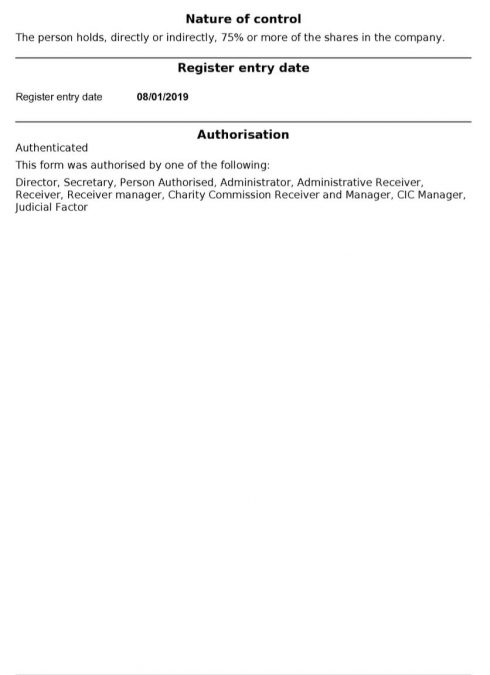

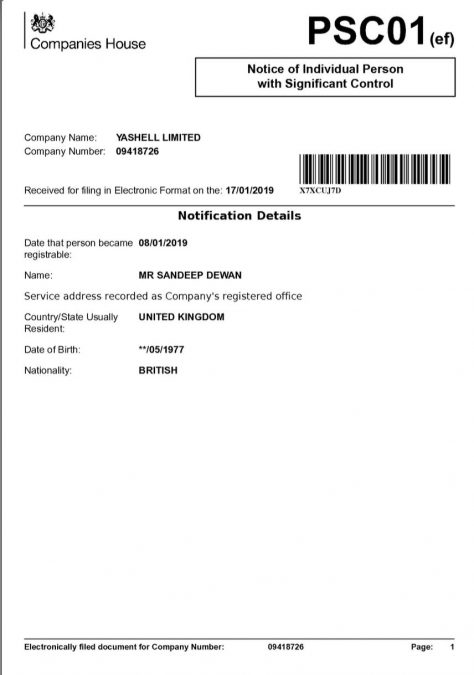

He establishes a company named Yashell Limited in England and partners with someone named Sandeep Diwan, presenting this company as the major creditor of Binas Energy for $30 million, forcing the bank to overlook the principal and interest of its claims. With Hassan Khamenei’s influence, he obtains a bankruptcy ruling for Binas. He has been fleeing Iran for years and is settled in London under the identity of Ali Aidan, but continues to conduct major business with Iran under the name Ali Farahmand and influences the appointment of key positions in the Ministry of Industry, Mine, and Trade and the Ministry of Oil.

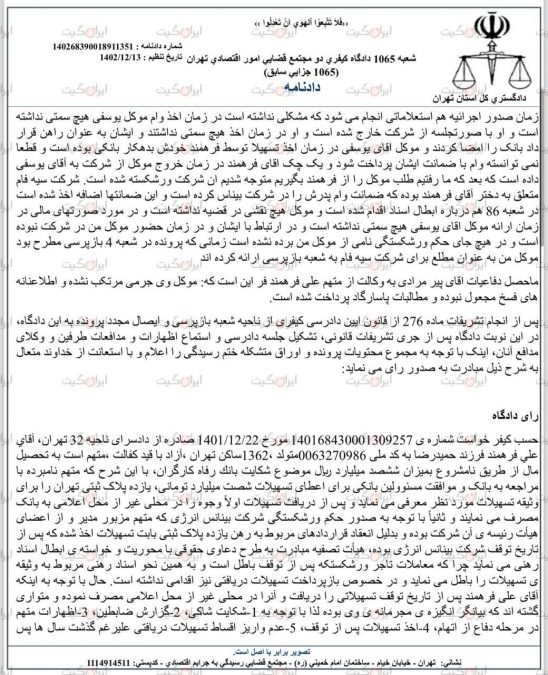

Ali Farahmand, aka Ali Aidan, also with the support of Mohsen Delaviz, the CEO appointed by Tajgardoon at Pasargad Oil, and in collaboration with Yaser Farzin, Tajgardoon’s cousin’s son, who had connections with corrupt individuals like Emami and Farahmand, despite the fact that Farahmand’s documents were mortgaged for large loans from Refah Bank, re-mortgages the property documents that were held as collateral with Refah Bank to Pasargad Oil with coordination from Tajgardoon and Hassan Khamenei. Farahmand once again receives tens of thousands of tons of bitumen equivalent to $16 million on credit from Pasargad Bitumen, sells the bitumen abroad, receives the funds in his exchange account, and after paying commissions to Pasargad Oil managers and corrupt political officials, transfers the remaining money to Dubai and London.

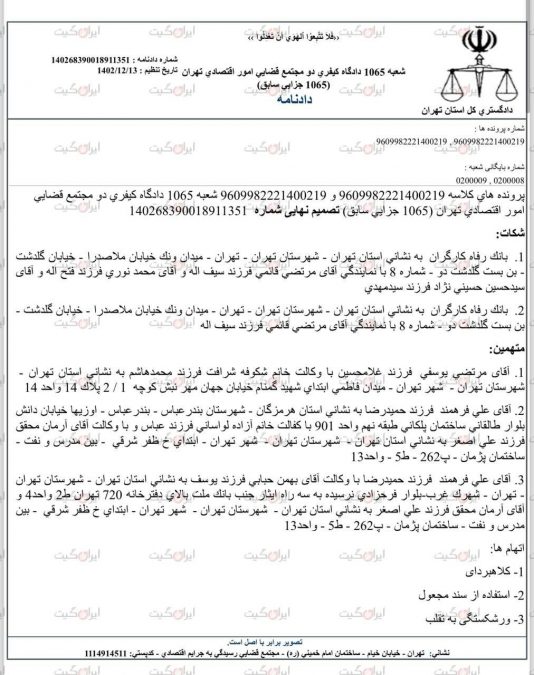

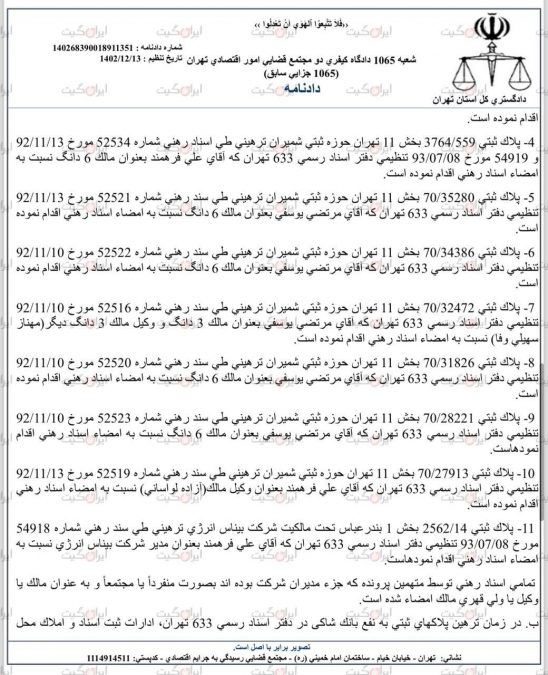

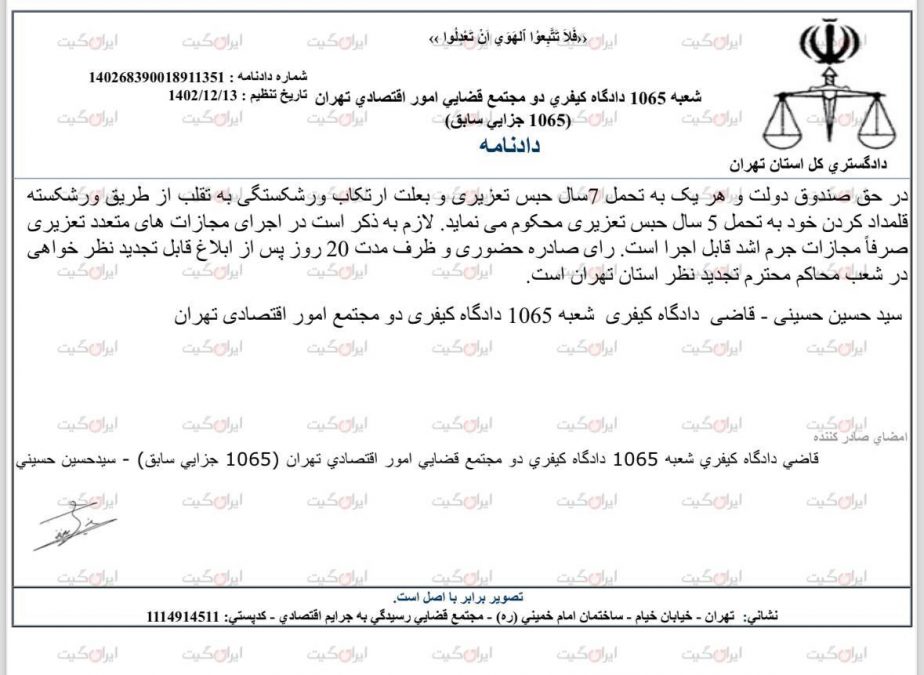

According to court documents exclusively obtained by Iran Gate, a criminal court decision from Tehran Economic Affairs Judicial Complex, Criminal Division 1065, final decision number 140268390018911351, Ali Farahmand is criminally convicted for forging multiple official documents and fraudulent bankruptcy. Additionally, due to the occurrence of multiple forgeries of official release of mortgage notices from 10 mortgage documents with Pasargad Oil, he is convicted of fraud and obtaining property through illicit means.

Interestingly, since 2019, although this case is open, Farahmand is nominally sentenced to years in prison and restitution, but he continues to trade with Iran without any issues and maintains extensive connections within the judicial and security systems. Farahmand is never summoned in the country, nor is a red notice issued against him by Interpol.

He even appoints the investigator and judge for his cases, the latest being Mohin Sadatnejad, who was removed from his position after issuing a non-prosecution order for Farahmand in exchange for one million dollars.

Given that Ali Farahmand, known as Ali Aidan, has a criminal conviction and is one of the largest major bank debtors, how has he managed to obtain residency in England and engage in business? How, despite his criminal record and illegal exit from the border, has he managed to obtain a Turkish passport? Why does the judiciary, despite identifying this individual, not take action to extradite him?

Additionally, according to reports from multiple sources, at the request of Iran’s Ministry of Intelligence, Ali Aidan, by purchasing a security company named Amadeo and obtaining the relevant security licenses in England, under the cover of the Amadeo company, attempts to infiltrate the European security products market with the aim of purchasing sensitive equipment for the Islamic Republic and also accessing sensitive security protocols and information. In exchange for providing this security service to Iran, the Ministry of Intelligence prevents the pursuit of this individual’s case.

One of the issues raised is that Western governments must be very cautious regarding the presence of Islamic Republic agents in their countries and should monitor such individuals closely, both financially and commercially. Given their criminal convictions for fraud, forgery, and multi-million dollar debts, where the source of their funds belongs to the Islamic Republic or is unclear, and their money laundering activities, they should be seriously held accountable.