Ali Aydan The Shadow Operator Behind a Global Web of Fraud and Laundering

Ali Aydan, a name that has become synonymous with sophisticated financial deception, stands at the center of an intricate web of fraud and money laundering that spans continents. Formerly known as Ali Farhmand, Aydan’s criminal saga unfolds with him holding passports from Iran and the Dominican Republic, only to embrace a new identity with a Turkish passport.

A maestro of manipulation, Ali Aydan has perfected the art of siphoning funds from banks and unsuspecting clients through elaborately crafted profiles. This cyclical pattern of deceit, recurring every seven years, has left its mark in Iran, Turkey, Dubai, and now, the United Kingdom.

Ali Aydan, in a bold assertion of credibility since 2022, has masqueraded as an ex-board member of Koc Holding and a fictitious alumnus of Istanbul University. This, despite his rudimentary command of Turkish, betrays a history devoid of academic pursuits outside Iran or any professional ties to the Koc Group.

His modus operandi involves leveraging an Iranian ID for unauthorized ventures, utilizing a Dominican ID to funnel earnings to Turkey and Dubai, and subsequently employing a Turkish ID to launder money from Ali Farahmand to Ali Aydan in the UK, a scheme facilitating both tax evasion and money laundering.

At the heart of this duplicity lies the revelation that Ali Aydan and Ali Farahmand, though seemingly distinct in the banking system, are indeed one and the same. Investigations have peeled back layers to reveal Aydan as an Iranian agent, an officer within the Ministry of Intelligence of Iran, aided in his endeavors to morph his identity and birthplace.

The narrative of Ali Aydan intersects with his past as Ali Farahmand, once a notorious figure in banking circles and the principal behind Binas Energy, a company deeply intertwined with the petrochemical and oil sectors of Iran. Farahmand’s history is marred by significant debts, arrests, and a complex relationship with Iran’s security and intelligence sectors, ultimately contributing to political campaigns and exploiting his positions for personal gain.

Ali Farahmand’s transition to Ali Aydan was not merely a change of name but a strategic move to elude international law enforcement, facilitated by a web of corruption, bribes, and the covert assistance of security agents. This metamorphosis allowed him to continue his economic machinations under new guises, further complicating the efforts to hold him accountable.

As Ali Aydan, he has ingeniously navigated the murky waters of international finance, transferring significant assets to the UK under the guise of legitimate business, all while maintaining indirect ties with the economic interests of the Islamic Republic through foreign companies.

The tale of Ali Aydan is a stark reminder of the challenges posed by the oil and petrochemical mafia of the Islamic Republic of Iran. It raises pressing questions about the efficacy of international regulations and the ease with which individuals like Aydan exploit legal and financial systems across borders.

Western countries are now confronted with the daunting task of addressing how individuals linked to the economic underbelly of the Islamic Republic continue to operate within their jurisdictions, casting a long shadow over the integrity of global financial institutions.

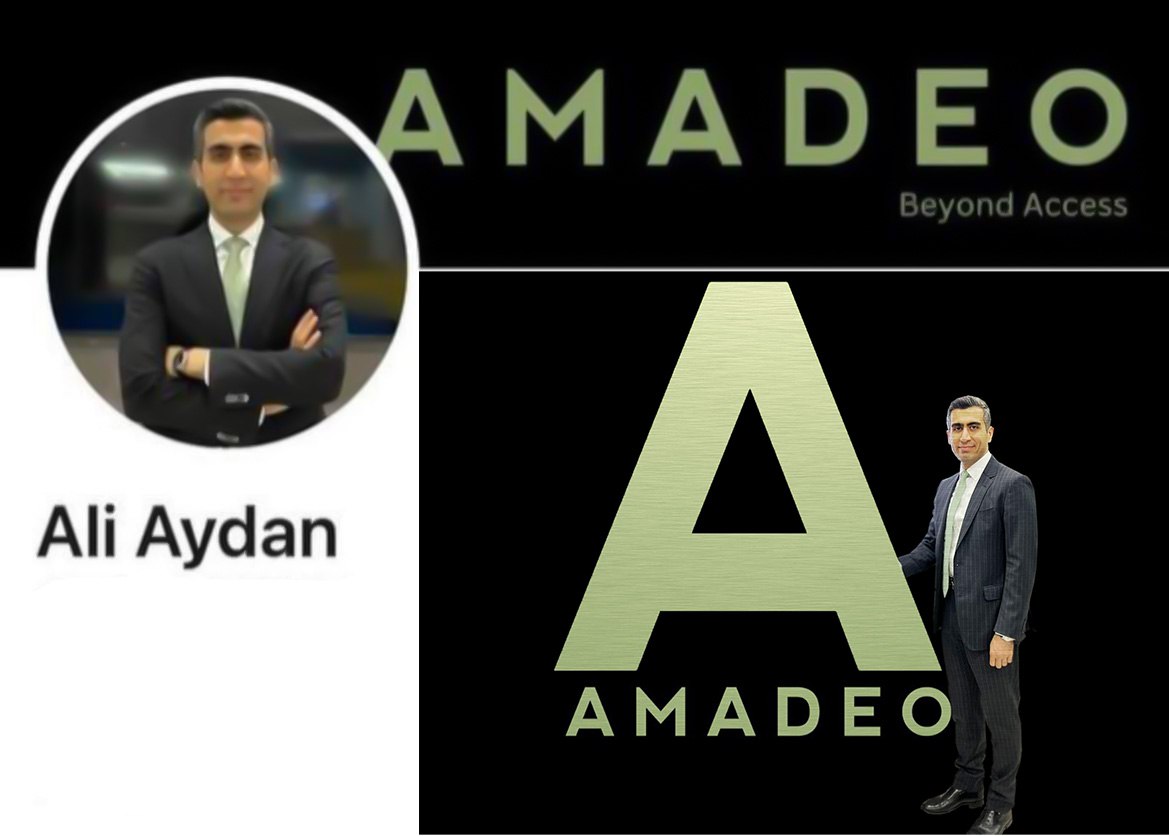

Ali Aydan has recently invested in an Austrian security company named Amadeo. This company has been taken over by trustees of the Iranian regime, allegedly to conceal their Iranian spies within the EU and to gain access to sensitive buildings through this company.

P.S. For further insights into Ali Aydan’s past as Ali Farahmand and his notorious banking crimes, refer to the previously published article “Who Is Ali Farahmand, The Corrupt Banker?” by Saeed Aganji on IranGate News. This piece sheds light on Farahmand’s activities within the petrochemical and oil sectors of Iran, highlighting his debts, legal troubles, and the intricate web of corruption and influence he navigated.