Light and Shadow in China’s Crisis-Stricken Capital Market

Last week was an important week for China’s economy and financial sector. The officially released statistics have portrayed China’s near economic future as more ambiguous than previously thought, and following the certainty of the disordered state in finance and various industries, China’s central bank was forced to react and cut interest rates. China’s construction industry is in serious crisis, and the giants of this industry are struggling to stay afloat.

China’s economy is so intertwined with the global economy that the small and large crises resulting from the spread of COVID-19, the absolute and comprehensive lockdown of major Chinese cities that continued until recent months, and the slowdown in China’s production cycle still affect the economy and consumer markets of various countries. However, beyond these, it is China’s capital market and financial sector that are facing significant fluctuations and serious puzzles about their future.

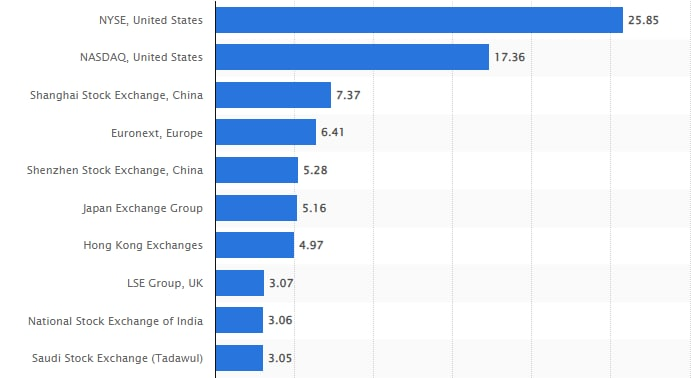

The value of China’s capital market is significant.

With the integration of Hong Kong’s capital market into China’s economy and finance, the country now possesses one of the most important capital market networks in the world. The Shanghai and Shenzhen stock exchanges have been attracting serious investment in recent decades, and under normal conditions before the COVID-19 crisis and even in 2021, China’s capital market, based on accumulated capital aggregation and financial turnover of various stock markets, was the most powerful and forward-moving in Asia and the main competitor to New York.

Various Crises and Market Shocks

COVID-19 overshadowed everything, and in the midst of this, various aspects of China’s politics and economy were affected. The policy of maximum confrontation with COVID-19 and the absolute shutdown of cities and industries naturally instilled the first doubts in the hearts of investors. Gradually, it became wise for many investors to reconsider their behavior towards the Chinese market.

Many prominent figures in the finance sector who had brought their money to China began diversifying their stock portfolio and gradually and seriously distanced themselves from high-risk bonds and stocks. The earthquake in China’s construction sector was one of the most pivotal and important factors that showed mid-level and even major investors in China from late 2021 that in certain conditions, the best strategy might no longer be diversifying the investment portfolio, and a round of stock selling and perhaps even withdrawing capital is the most sensible policy.

Major Sales and Fluctuations

Periods of serious stock selling and capital withdrawal by foreigners affected China’s capital market. Meanwhile, there was no serious doubt about the Chinese government’s ability to help the crisis-stricken sectors, and at the same time, what was important was the crisis in sectors like housing, which involved various international companies and investors, especially American ones.

The crisis resulting from strict COVID-19 regulations and city lockdowns, especially in a city like Shanghai, was a serious issue in itself that affected the performance of industries and companies and, consequently, the stock market. The significance of COVID-19 regulations and the resulting constraints was such that the relative reopening of some cities and the easing of restrictions led to a good growth period for the Shanghai and Shenzhen stock markets in April and June. Despite being in the red performance zone over a year, they grew in conditions where New York and European markets were negative in the same specific period, and this was only due to a period of relative easing of COVID-19 restrictions.

Investments in the production sector in China bore the burden of the housing sector’s losses and damages, and stock transactions in this sector experienced significant growth. However, periods of stock selling and capital withdrawal from China have not stopped. China’s bond market has been seriously damaged in the past six months, and many current participants are betting on the loss of these bonds, placing their capital on the further decline of these stocks.

New Statistics and Even Newer Puzzles

The release of official statistics and estimates of China’s economy by the country’s officials has somewhat increased concerns about the crises facing this country. These concerns were serious enough for the Chinese officials to prompt the central bank to quickly react and cut interest rates. From Monday to Friday of the just-ended week, experts from various economic sectors in the US and Europe are analyzing and discussing these statistics and providing their estimates about the outlook of China’s various industries on one hand and the capital market on the other.

Growth in various sectors of China has been less than predicted, and youth unemployment has increased. In the one-month period from June to July, the decrease in sales and pre-sales in the housing sector has become more serious and worrying. Based on this and the 42% inflation and possibly worsening estimates of China’s gross domestic product growth, experts are continually lowering their estimates. The domestic capital market in China and non-Chinese investors cannot rely on these developments.

DMCA Cover