Good news for Europe’s economy and livelihood

Exciting days unfolded for the stock market and the economy and livelihood of Europeans at the end of August. Recent reports on price growth statistics in Germany indicated a 2% inflation rate, which is the best possible news for this country under current conditions. This is because news about the state of Germany’s economy had caused serious concern with the re-recording of contraction. A slight 0.2% growth in the first quarter of this year was accompanied by a 0.1% contraction.

Naturally, this trend of decreasing inflation rate is related to the reduced spending by Germans, and it is the economy that suffers from the reduction in money circulation and consumption.

The conditions of increased spending and money flow without a serious rise in prices and inflation are the conditions of a dynamic economy, which the U.S. under Biden is reaching after overcoming the terrible inflation of previous years, pairing inflation below three percent with a three percent economic growth. The decrease in the inflation rate in Germany is, in any case, good news.

The European stock market has become more encouraged than ever by the new report on price growth statistics in the Eurozone.

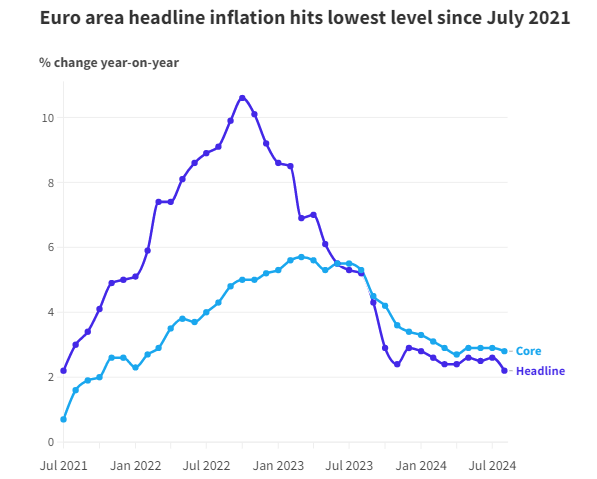

Inflation has reached 2.2%, the lowest level in three years, paving the way for another interest rate cut by the European Central Bank.

European stock markets have already counted on this interest rate cut and have considered it in their trades. Core inflation, which calculates the inflation rate without considering the prices of specific items like energy and food, stands at 2.8%, indicating high price increases in the services sector.

European experts have specifically warned about price increases in this sector. With the approach of autumn and winter and the renewed importance of energy prices, inflation in Europe might rise, but experts consider an inflation rate of around 2.5% for the coming months to be likely.