How the Stock Market Shrunk Under Raisi’s Government

The fluctuations of the Tehran Stock Exchange’s overall index in the first half of 2022 were much more severe than what experts had predicted. Meanwhile, the market’s situation led to a large volume of real money leaving the capital market without any replacement for the outgoing funds.

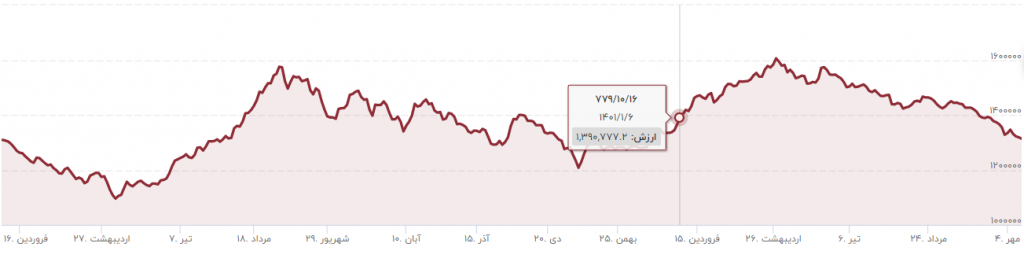

Ebrahim Raisi took over the executive branch when the Tehran Stock Exchange’s overall index was on a steep upward trend on August 3, 2021. The index was at the 1,375,000 mark, and many shareholders believed Raisi’s slogans would change the market atmosphere and boost both small and large real and legal transactions.

However, just one month later, with the composition of the thirteenth government’s cabinet becoming clear, the index’s fluctuations changed completely. The market entered a downward phase, and this situation continued until the end of 2021.

Artificial Green in the Stock Market in Spring 2022

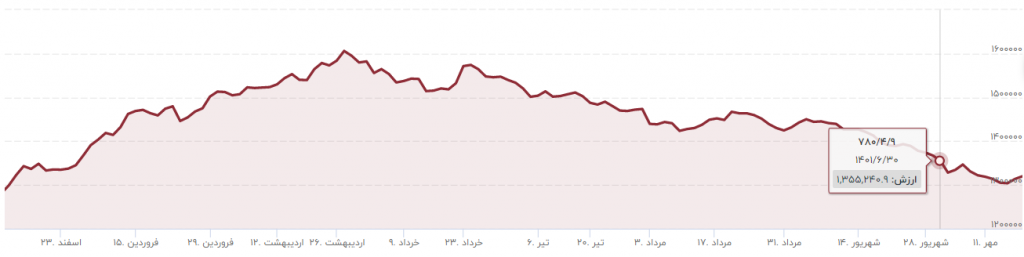

The Tehran Stock Exchange entered 2022 with the overall index at the 1,390,000 level. The fluctuations in the first quarter of the year resulted in an unexpectedly high spring return. However, most experts believe this growth was not due to the natural trend of the capital market but was the result of government interventions in the internal affairs of this sector.

For this reason, many predicted that the surprising upward trend of the stock market would not last long and would soon stop. This is exactly what happened, and the Tehran Stock Exchange’s overall index took a downward trend with the arrival of summer.

How the Index Melted in Summer

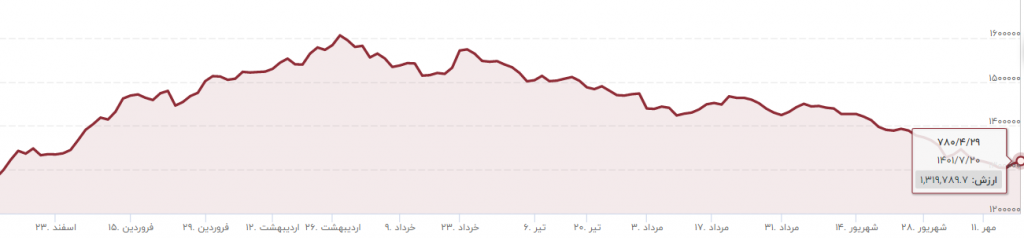

The fluctuations were so extensive and severe that analysts did not expect such a pattern from the index. Additionally, Ebrahim Raisi’s government, with its occasional and unprofessional interventions, exacerbated the recession prevailing in the market. The continuation of the thirteenth government’s directive economic policies led the overall index to reach the 1,355,000 level in September, the lowest level in 2022.

This happened while stock market shareholders were extremely angry and worried about the future of their investments in this sector. The concerns intensified to the point of leading to gatherings by dissatisfied and loss-bearing stock market participants. These protest gatherings, which were previously held in front of the parliament building and the Planning and Budget Organization, this time spread to the front of the Stock Exchange Organization, with slogans harsher than ever, and the Raisi government had no answers for any of them.

The Stock Market Today

As mentioned, the stock market ended the summer in unfavorable conditions. This situation continued into October with even greater intensity, darkening the investment outlook in the capital market. The overall index is on the brink of falling into the 1,200,000 channel, which experts consider the floor for 2022. Although some analysts view the situation more pessimistically and even believe the possibility of breaking this support floor in winter is not low at all.

The havoc that directive policies in micro and macroeconomic management wreaked on various markets has led to a large volume of real money, which once revitalized the stock market, saying goodbye to this market altogether. This has caused many stock market participants, despite suffering heavy losses, to consolidate their remaining capital and consider returning to other parallel markets.

Now, the number of risks threatening the market is increasing. Many believe that the Stock Exchange Organization, led by Majid Eshqi, will not be able to manage this level of risk. From the potential rationing of gas for industries in the coming weeks to the failed and protracted JCPOA negotiations under the thirteenth government, all are among the risks surrounding Iran’s economy and, consequently, the capital market. In the next part of this dossier, each of these risks and the government’s unprincipled management of them will be analyzed.

Numerous analyses and reports on the stock market and Iran’s economic situation have been prepared and compiled in Iran Gate. For convenience, we have listed a few related to this topic below.

- Raisi’s Super Slogans Were Hot Air

- Raisi’s Stock Market Promises: Slogans That Were Expensive for Nothing

- Disaster at Istanbul Intersection