Russia, Europe, and China in the Energy Battle of 2022

Russia, Europe, and China are engaged in the energy battle of 2022. Russia made headlines by cutting off the Nord Stream 1 gas lines, and within hours, not days, Europeans realized that new conditions would govern these lines.

Vladimir Putin made this decision firmly in response to the West’s implementation of plans to set a price cap on energy purchases from the Russians. At the same time, through his leverage in Europe, he successfully influenced European efforts to finalize the gas price cap plan, which was supposed to be approved at the EU energy ministers’ meeting, and halted its approval.

With the conditions arising from the continuous rise in energy prices in Europe and the current inflexible positions of most European countries, the energy battle of 2022 has begun with greater speed and force.

Russia Boasts About Its Oil

Documented statistics, which to some extent should take Russian figures seriously, reveal realities that are crucial for Europe and the USA, and also serve as a warning for Iran. One of the key points is the overall increase in Russia’s income from energy exports. The latest estimates show this increase at 38%, which can be astonishing under sanction conditions.

Such an increase in income has adjusted predictions about the decline in Russia’s GDP, and now there is an expectation of a 4.2% drop instead of a 12% fall in Russia’s economy. Meanwhile, Russia looks at the high prices of 2022 and realistically considers the impacts of various factors on its income from energy exports in 2023.

Russia’s Ministry of Economy and various energy companies have already accepted that their income will decrease in the coming year, although even in the worst conditions, their income will still be much higher than in 2021.

Another key point and reality is the multiple importance of Russian oil exports compared to its income from gas sales. In 2021, which was a record-breaking year for Russian energy income, according to their central bank statistics, income from oil sales was over $100 billion, petroleum products nearly $70 billion, pipeline natural gas $55 billion, and liquefied gas over $7 billion. In 2022, Russia’s oil income has greatly enhanced its ability to adapt its gas exports to Europe and has preemptively considered the reduction in exports to Europe as a significant loss in its policies.

The strategy to compensate for the loss is maximum oil sales. Alongside this strategy, Russia looks to buyers like China, which purchase gas in new processes and specific contracts from Russia. Meanwhile, the loser is Iran, which is deprived of even the minimum chances to sell its oil and gas under sanction conditions. China and India have become the most important customers of Russian oil, buying cheap oil that is up to $40 cheaper than the market rate.

China’s Game with Sanctions and Europe’s Fate

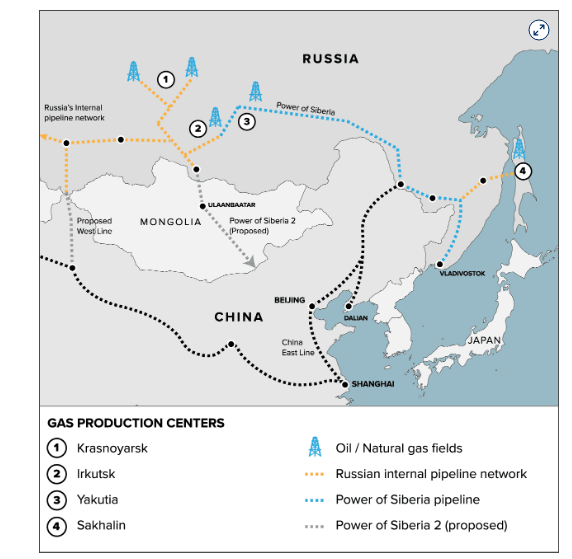

While Europe is filling its gas reserves and signing contracts with alternatives to Russian gas, a particular news item drew attention. Chinese companies are selling LNG shipments to Europe. A closer look revealed that naturally, these LNG shipments are Chinese imports from Russia, part of which they mischievously sell to Europeans. Extensive contracts for gas purchases from Russia by the Chinese have been signed, and this process wasn’t a topic of yesterday’s discussion; plans have been drawn for a long time. Russian gas pipelines from Siberia to China are very cost-effective for the Chinese due to the low prices and Russia’s flexibility in the type and method of payment.

On the other hand, this same China might soon have an adverse impact on the energy market due to its special COVID-19 conditions, which would be unpleasant for the Russians. The continuation of COVID-19 lockdowns, which the Chinese government has implemented with strict policies regarding the COVID crisis, leads to reduced economic and social activity, decreased movement, and reduced factory operations in some areas. This reduces China’s peak need to purchase oil. This specific development has been affecting oil prices for some time, and it is unlikely that this impact on oil prices will not continue if absolute COVID lockdowns persist.

In any case, and beyond all these points, China is adjusting the impacts of sanctions on the Russian economy by purchasing high volumes of oil and gas from this country. Especially with the high oil purchases from this country, it compensates for some of the losses from the reduction of Russian gas exports to Europe. It must be emphasized again that Russia has preemptively eliminated the serious export market for Iranian oil in China and India. The Chinese achievement in this context should only be considered as a 50% discount on gas purchases from Russia, which will continue until the end of 2022.

Europe, China, Turkey, and the Economic War

Vladimir Putin and his subordinates have boldly and openly declared these days that until Russia’s conditions in the global economy normalize, they will keep the Nord Stream 1 lines closed. More mischievously, the Russians’ comments about the closed Nord Stream 2 lines were made, suggesting to Europeans with a hint that they should retract their action in closing those lines.

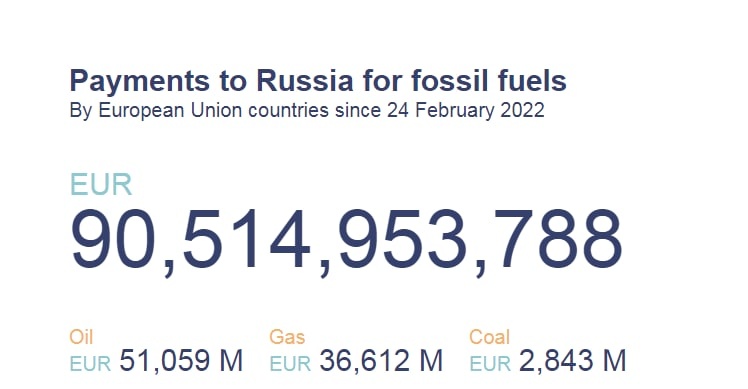

However, another reality must be added to the realities we mentioned earlier. Europe is a financial and income source for Russia in a situation where it has gone to battle with this country and is, in fact, paying the costs of its enemy. One of the independent European research centers that has announced the latest protests about this as a warning to EU officials is the European Center for Research on Energy and Clean Air, which has officially presented its research findings to European officials.

According to the announced statistics of this institute, Europeans, by purchasing €85 billion worth of oil and gas from Russia, have been the most important source of income for this country in the months following the invasion, and this amount has exceeded $90 billion after the finalization of the results of those investigations. Interestingly, two other major countries buying oil and gas from Russia are China and Turkey. Turkey’s purchases from Russia are nothing but a warning for Iran.

The European Union is striving to finalize special policies to counter Russia and the constraints resulting from the economic and political battle with this country. In future reports and narratives about the energy and livelihood crisis of 2022, we will address these policies and the global energy crisis map, which intertwines the borders of competition and interactions of many countries.