Copper and gold are equal

Copper and gold are equal. The CEO of the National Iranian Copper Industries Company announced a new discovery in the Sungun copper mines in East Azerbaijan. According to his statements, the known amount of copper in these mines following a massive recent drilling increased from 4 billion tons to 5 billion tons. This significant new discovery is good news for Iran. However, the major puzzle regarding copper mines, their extraction, and related income issues naturally involves the equations of private sector copper companies, the export process, and how the resulting currency returns.

Beyond that, the groundwork laid for the export of this product, which private sector companies benefit from, must be assessed in the context of sanctions and the absence of the JCPOA. Any blessing provided to them under sanction conditions should face serious taxation to ensure that the rights of the people, as the true and sole legitimate owners of the country’s mines and wealth, are not lost.

Imposing special taxes under sanction conditions on individuals and companies that are provided with export opportunities is essential. Beyond this foundational warning, the discussion of this article is about copper.

The general rule of global economic interactions involves discussions about the skyrocketing prices of strategic metals and minerals. In the months following the relative stability of various countries after the Corona crisis, which coincided with Russia’s invasion of Ukraine, the price of a specific group of strategic metals and minerals, on one hand, and the supply and distribution cycle of their processed products, on the other, became a topic of expert discussion and beyond that, a concern for politicians and governments.

If lithium and cobalt were the major puzzle of many new plans or the development of existing battery and electric vehicle lines and many other products, their importance for the key discussion of investment in combating climate change is evident. Naturally, products like electric vehicles play a serious role in changing the trend of fossil fuel consumption in the world. Another metal that is tied to the massive investments allocated to fighting climate change is copper.

Copper was pure gold and will become even more golden.

Copper, which had taken the most golden role in the electrical industry, has always been important. A metal that is a capable conductor and has given life to power lines, telegraph, and telephone, and since the mid-19th century, with the technological transformation of modernizing urban life, has given meaning to lighting, heating, and communications.

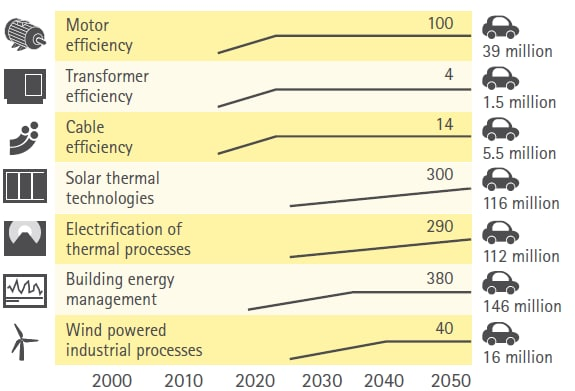

Emphasizing the historical and traditional importance of this metal is redundant and stating the obvious. However, what must be emphasized is the global movement to combat climate change, which has turned copper into one of the most important forces in this battle. Almost all clean energy production facilities and technologies, whose investment and production are now a priority for many governments, rely on copper.

If the production and processing of this metal itself were also polluting due to its specific extraction and processing process, developments in related technologies have significantly reduced its pollution in modern mines and industries worldwide. Now, all eyes are on copper resources, copper prices, and the dominant forces in the copper market. Three specific periods in recent decades must be identified when examining the impact of copper on the world.

Before the early years of the third millennium, Europe and America, with their factories and productions, were the most significant copper consumers in the world. After that, the third millennium began with China’s influence. China became a production hub, and foreign industries that moved to China to benefit from cheap labor facilitated China’s transformation into the most important copper seeker in the world. The third era should be considered the era of a carbon-free world, which is supposed to realize its dream by 2050 for Europe and America and will significantly increase the global need for copper.

Where is copper and what has it done?

Copper is known to enthusiasts of politics and contemporary world history with Chile. The days of the 1970s and Chile’s key copper industry, which emerged as the most important owner of this metal in the world, the coming to power of Salvador Allende in that country meant distancing Chile’s politics and government from American interests and led to the bloody and regrettable coup by Henry Kissinger in that country, bringing Pinochet to power.

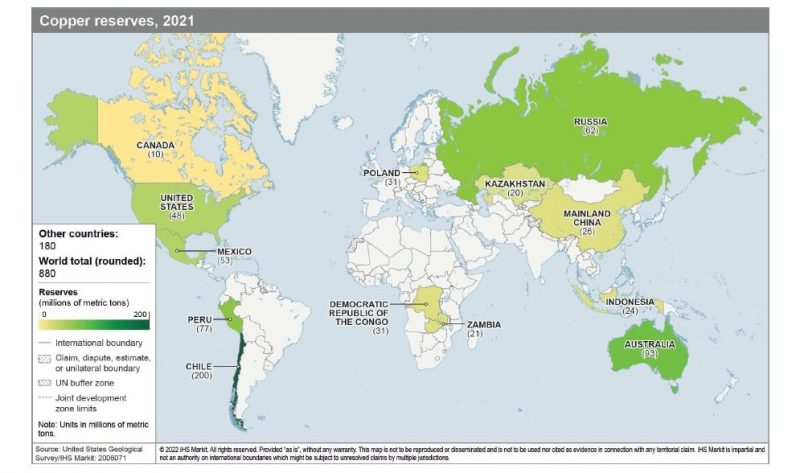

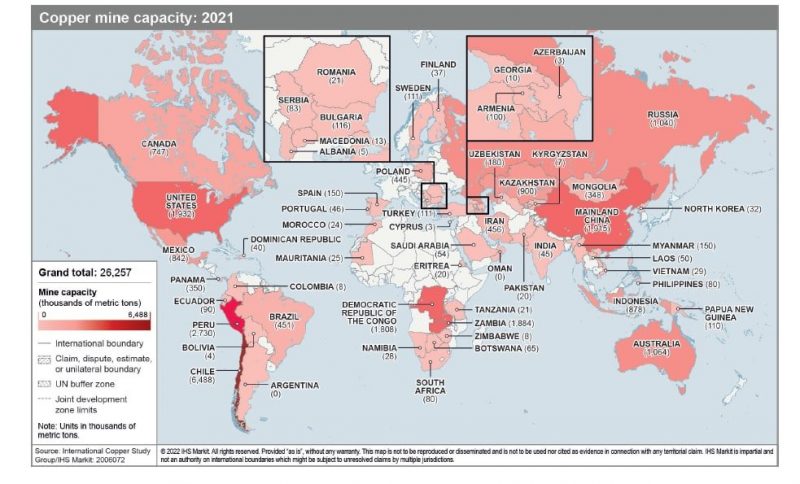

Apart from Chile, China and America, which are in confrontation and battle with each other, have significant copper reserves. It should be noted that good, significant, and high-quality resources that are easy and economical to extract can be found in specific countries. Chile and Peru in South America, Congo and Zambia in Africa, and China in Asia have the most copper resources. The new equations of world politics and economics now look to China and copper.

China and Copper

China is the most important player in the copper show. One act of it has been staged in an unexpected and unusual place, which is none other than Afghanistan. The exploitation and development of the large Logar copper mines in this country have been significantly expanded and dominated by China in friendly cooperation and interaction with the Taliban in just the past couple of months.

One of the important reasons for the hidden political competition between China and America in a country like Congo, apart from strategic metals like cobalt and lithium, is the importance of this country’s copper mines. China, which has become a benefactor for Zambia, recently took over the presidency of a working group consisting of countries that are creditors to Zambia and helped clear part of Zambia’s debt. Of course, China is the largest investor in Zambia’s rich copper mines.

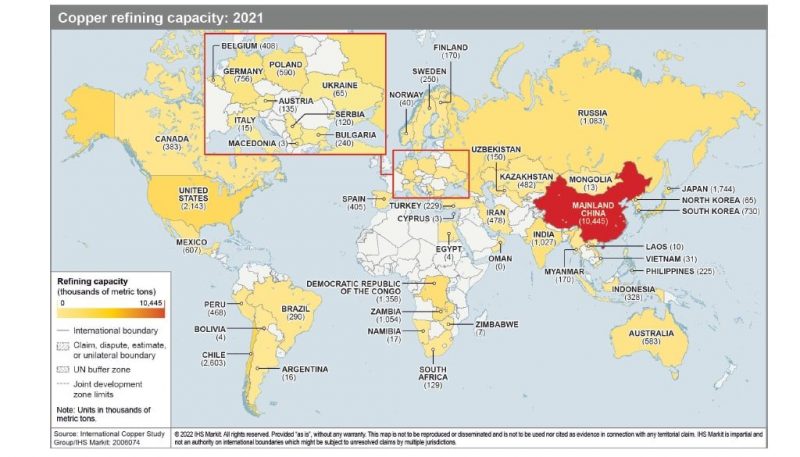

Beyond all this, China, which itself has significant copper resources, due to its endless need for this metal, has greatly increased its processing capacity on its soil, and copper processing facilities and industries in China are the unrivaled rulers of this industry in the world. It is this superiority that has made China dominate the supply and distribution cycle of this metal.

The Near Future and the Copper Crisis

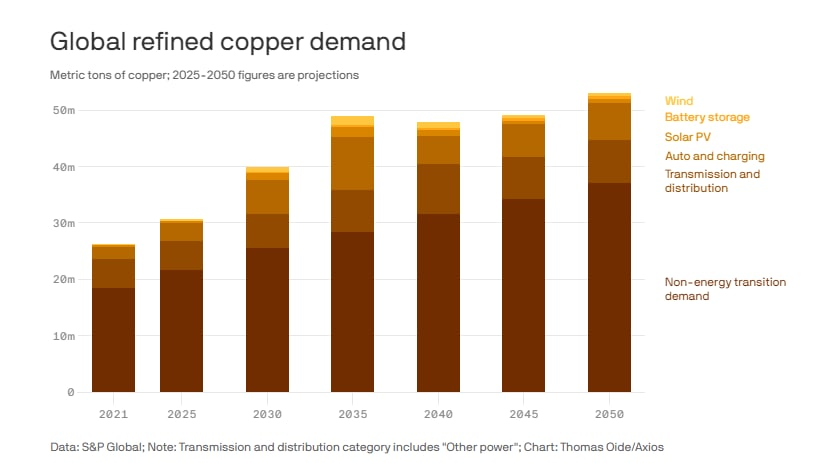

The most important point about copper as a strategic metal is the multiple increases in the needs of industries and markets in various countries for this metal. Since the middle of last year, concerns about the ability to supply copper for various industries in countries around the world have peaked. Now, a detailed report by the SP Global Strategic Studies Institute has been preoccupying all experts for some time.

Experts at this institute, in their report on the achievements of their recent extensive research, have explicitly warned policymakers about the growing global need for copper in the shadow of the world’s push to develop clean energy production industries and zero out fossil fuel burning. According to this institute, the crisis of supply and demand imbalance in the copper market may begin in the middle of this decade.

In any case, until 2050, the world will be seriously and increasingly in need of copper. The United States, under Biden, has made a significant move to rely on domestic production and supply of strategic metals, and apart from developing mines, it wants to maximize the processing of minerals that it does not have in its soil domestically. Europe looks at copper as the currency of the fight against climate change, and its plans for copper supply are serious.

In this situation, the news of the discovery of new metal reserves like copper is important and big news for Iranians, and it is to be hoped that the profits from this God-given blessing will reach the true owners of these mines, who are the people of Iran.