Earthquake and Economic Collapse of China 2022

In a country like China, which was supposed to be governed based on socialist and communist principles and has now transformed into a structure based on state-driven capitalism, it was natural that for years the concept of homeownership for citizens based on construction and transactions in the private sector would not have any meaning. The transformation that took place after the early years of reforms in China was comprehensive, and one aspect of it was precisely this housing sector and its relationship with the nascent private sector.

The first steps were taken by the Communist Party during the ongoing reforms by encouraging government employees to become homeowners through the newly created and expanding private sector. Over the years, the construction industry gradually reached a point where it is now one of the main pillars of the American economy. If we account for the developments of the past year, this pillar is very shaky.

The construction industry is almost everything.

The revenue of China’s construction industry in 2020, as a benchmark for the normal economy before the COVID era, was 17 trillion yuan. There is no rival for such an industry in the market for attracting investment leading to production. Various Chinese companies became historically renowned as pioneers in attracting investment for housing production and pre-selling large projects worldwide.

Among these companies, Evergrande was the most famous and wealthy. This giant of the global construction industry, which went through a round of bankruptcy this year, was the center of all news in China’s and the world’s construction industry. Under ideal conditions, this company had nearly 600 million square meters of land and housing. The crisis of inability to pay dividends and various installments by this company in late 2021 and early 2022 signaled the peak of the construction industry’s crisis.

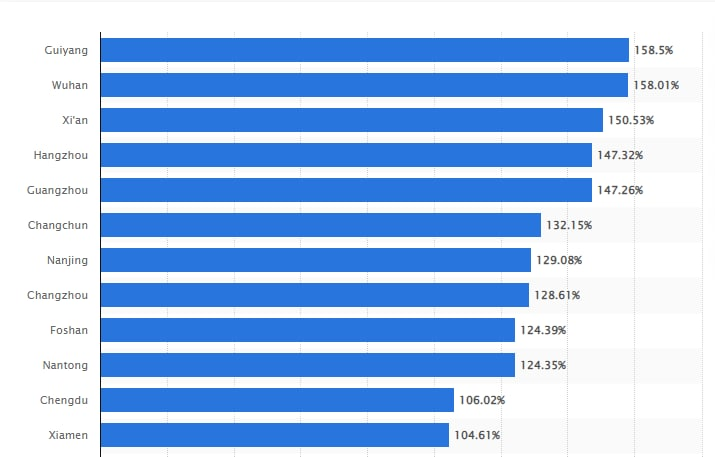

For the Chinese, if the construction industry isn’t everything, it is the most important factor for capital and income for significant parts of this country. For Chinese citizens, in a situation where the transition from a socialist-communist economy has occurred and a state-driven capitalist era has been established, it is the most important area for investment.

Pre-purchasing construction projects is one of the few ways for Chinese people to invest, as they can hardly and almost impossibly make serious investments outside this country, and the communist government has created numerous monopolies for them. For regional governments, construction companies, and real estate transactions, the revenues from registering the sale of national land to companies for skyscraper construction and all revenue items were the lifeblood of budgets. A significant portion of China’s regional governments is funded by this sector, equal to or often far beyond the approved budget.

The crisis arrived.

The COVID crisis began the fall of various sectors, and in these conditions, considering the serious economic and societal crisis in China, with the complete and definite dependence of cities, citizens, and society, housing companies gradually faced more problems. Long before the COVID crisis, for several years, the crisis of numerous built and vacant towers and malls was one of the famous stories about China. After the COVID era, another crisis emerged.

Companies’ revenues decreased, and their ability to complete projects that they had pre-sold long ago diminished. In December 2021, Evergrande recorded its first round of inability to pay dividends and installments, and alarm bells rang until it finally officially entered a state of limited bankruptcy.

Evergrande faced a financial burden and responsibility valued at 400 billion dollars. The mentioned period until the official announcement of Evergrande’s limited bankruptcy was a period of intense focus by economists, market experts, and researchers on China’s construction industry. What received less attention was the issue of Chinese citizens who had purchased pre-sold and incomplete construction projects.

Quasi-Civil Resistance

China is experiencing various economic problems, big and small, after the COVID era. The policy of complete and total city closures, especially in a city like Shanghai, put a lot of social pressure on people. No expert expects widespread public and civil protests in China. However, some protests regarding financial issues that weakened small banks and troubled people were held by the public, which were very limited.

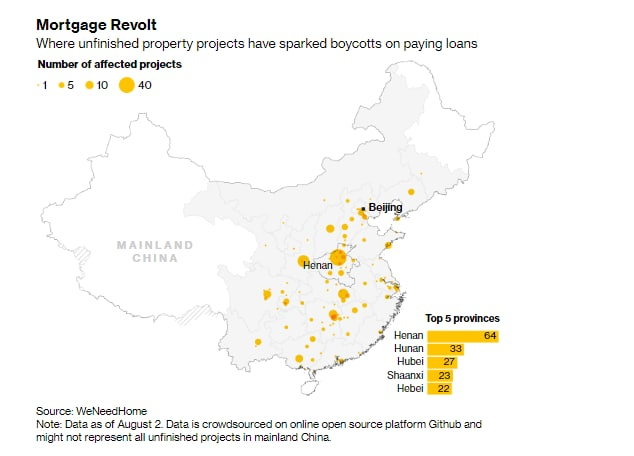

The special civil protest related to construction, however, is something else. About two months ago, 900 Chinese in one of the country’s cities, in protest of the non-completion and delivery of their pre-purchased project, refused to pay installments to Evergrande, and this was just the beginning. The cases of non-payment of installments increased day by day, reaching a point where construction companies caught in the anger of customers contacted banks and announced that their institutional and company monthly payments should be stopped.

Because people will not pay installments, and no money will come into their accounts, this is a crisis for the banks themselves. Housing installments are one of the best sources of income and cash flow for Chinese banks, and naturally, they are bewildered by the quasi-civil resistance of the people in paying installments. It reached a point where central and regional government officials took action and, by taking some steps, encouraged banks to cooperate financially with construction companies to help complete their projects. The value of citizen installments in the construction industry for unfinished projects is at least estimated at 220 billion dollars.

China’s economy is facing serious growth reduction, and the best estimate in the current situation is registering only a 3% growth in 2022, which would be a dream. Various crises in investment sectors, especially the construction industry and other issues, led the People’s Bank of China to recently significantly reduce interest rates. The construction industry alone accounts for one-third of China’s economy, and the crises in this sector continue to shake and collapse the Chinese economy.