The Major Corruption in Masjed Soleyman Petrochemical

The Major Corruption in Masjed Soleyman Petrochemical: What’s happening at Masjed Soleyman Petrochemical? According to Iran Gate, the petrochemical industry during sanctions, due to its foreign exchange transactions, is recognized as a suitable area for exploitation by sanction profiteers and economic corruptors. The Masjed Soleyman Petrochemical complex, being a state-owned company, has become a playground for profiteers under the shadow of sanctions and the lack of JCPOA revival.

The Masjed Soleyman Petrochemical complex was built in 2019 in the Zilaei area of Masjed Soleyman County, spanning 400 hectares. Located 130 kilometers northeast of Ahvaz and 30 kilometers from Masjed Soleyman city, it operates in producing products such as ammonia and urea. Given the high foreign exchange earnings of the petrochemical industry, the Masjed Soleyman Petrochemical Holding was established and operationalized during the twelfth government to reduce the pressure of sanctions on the country’s economy.

The production lines of this complex came into operation in May 2021, and the company succeeded in producing urea and ammonia. In other words, the investment made during the twelfth government was handed over ready to the government of Ebrahim Raisi. However, reports from this company indicate serious suspicions regarding the sales contracts of this industrial complex.

A Contract That Was Never Executed

The pressure of sanctions and the inefficiency of the thirteenth government’s foreign trade policies have led to a decline in sales for producers in various fields, including petrochemicals. Masjed Soleyman Petrochemical Holding is one of them. However, most companies active in this field, due to their strong background, have been able to withstand the pressure of sanctions so far, but this is not true for the young and new Masjed Soleyman Petrochemical company.

According to reports available to Iran Gate, the company’s officials, to provide the necessary liquidity to continue the holding’s activities, have proceeded to sign a contract for the immediate sale of urea. As mentioned, due to the company’s failure to sell its products at the beginning of the current year, it engages in a suspicious contract.

During a meeting held by the company’s officials, the sales committee on June 18, 2022, finalizes a contract between Masjed Soleyman Petrochemical and Pars Saba, the trading company of the National Pension Fund. It should be noted that this meeting was held at the Pars Saba office with the presence of the CEOs of both companies.

In this meeting, where the parties discussed the problems and obstacles in the production and sale of petrochemical products, it was decided to conclude a contract between the two entities for the immediate sale of urea produced by Masjed Soleyman Petrochemical Industries.

This event occurs when the petrochemical company urgently needs liquidity due to the fear of gas cuts in the production unit. Ultimately, according to the regulation, it is decided that Saba International will immediately purchase 50,000 tons of urea from Masjed Soleyman Petrochemical to save this complex from problems such as gas cuts. According to the agreement made in this meeting, each ton of urea would be immediately provided to Pars International for $470 cash by Masjed Soleyman Petrochemical.

However, according to reports available to Iran Gate, after the mentioned meeting, the immediate and cash sale and other contract approvals are halted, and the emergency liquidity channel for Masjed Soleyman Petrochemical is blocked.

Crisis in Masjed Soleyman Petrochemical

Following the events mentioned earlier, actions are taken against the managers of both companies, especially the then-CEO of Masjed Soleyman Petrochemical. As a result, the CEO is removed from the board of directors, and his powers regarding product sales are transferred to specific individuals.

This action leads to an illegal approach in product sales. On the other hand, some reports indicate ambiguities in the company’s revenue and the provision of the necessary liquidity for this complex. According to findings from some informed sources and their comparison with official references and the company’s financial statements, it appears that a part of the revenue from the company’s sales has been inexplicably removed from the revenue line.

Five Mysterious Companies

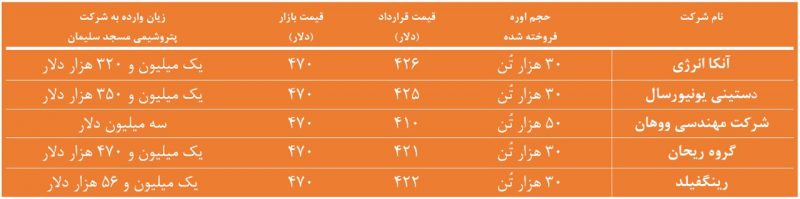

Findings from Iran Gate indicate that a large portion of this company’s production is transferred to 5 domestic and foreign companies. According to these reports, Anka Energy receives 30,000 tons, Destiny Universal 30,000 tons, Wuhan Engineering Company 50,000 tons, Reyhan Group 30,000 tons, and Ringfield 22,000 tons in one day and illegally obtain a PI.

Meanwhile, each of these companies, which will be detailed later, purchased Masjed Soleyman Petrochemical products at $50 to $60 below market price. This issue is one of several suspicious cases that occurred in the absence of a sales committee and due to the illegal process of selling and issuing PI.

Naturally, each of these five companies, due to the high profit margin they gained from this contract, should have promptly deposited the funds. Where’s the flaw? However, several important questions arise in the meantime. The first point is the reason for stopping the implementation of the sales committee’s legal approvals from June 18, 2022. On the other hand, the reason for not holding an official sales committee meeting is unclear to anyone.

As mentioned earlier, the issuance of PIs at different and significantly below market prices is not mentioned in any report. However, this action has not only caused corruption within the complex but also, given the high volume of contracts with the five mentioned companies, has affected the country’s urea market. In other words, due to the underpriced supply of urea by specific individuals at Masjed Soleyman Petrochemical, the market rate is also broken.

This event has many beneficiaries, including foreign buyers and some domestic brokers. Naturally, foreign applicants succeed in obtaining their needed raw materials below cost due to this action. Brokers, due to paying less, gain a much higher profit margin. On the other hand, it should not be forgotten that Masjed Soleyman Petrochemical, due to its urgent need for liquidity, had to sell its products urgently. However, this level of discount has resulted in a large portion of production costs not returning to the company’s account. In other words, the lost profit for Masjed Soleyman Petrochemical is another issue that should be considered.

Mireid Shooshtari and His Role in This Case

First of all, it should be noted that according to the approvals of the Masjed Soleyman Petrochemical sales committee, no intermediary can be present in all stages of product sales. However, given the existing evidence, brokers and intermediaries have had an active and prominent presence in the transactions with the five mentioned companies. However, the trace of Mireid Shooshtari is clearly visible in all illegal urea sales stages over the past two months.

In the meantime, the issuance of various PIs at different prices in just one business day raises the suspicion of what role the individual in question played in concluding the sales contracts. Meanwhile, according to the sales committee’s regulations, issuing a PI without coordination with the board of directors and below market price is not possible.

As mentioned earlier, Iran’s urea market has suffered significant damage. Based on the PIs issued by Mireid Shooshtari and despite the considerable increase in urea prices in global markets, severe damage has been inflicted on the country’s petrochemical industry. Therefore, the corruption case in Masjed Soleyman Petrochemical is not limited to this industrial complex but has national dimensions and is a clear example of disrupting the country’s economic system.

According to informed sources and matching the sales prices by Mireid Shooshtari with the Codal system and global markets, a damage equivalent to $50 per ton of urea has been inflicted on Masjed Soleyman Petrochemical. This is while, due to the Ukraine war, most commodity prices have been rising, but Iran’s urea market is severely in recession.

On the other hand, shareholders of other petrochemical companies were puzzled as to why, despite the global surge in urea prices, their shares faced losses. Now it becomes clear that part of this loss is due to the officials of the aforementioned contracts, of which Mireid Shooshtari is one. Iran Gate’s calculations indicate a direct loss and missed profit of $8,196,000 for Masjed Soleyman Petrochemical in just five illegal urea sales contracts by Mireid Shooshtari.

In other words, it can be said that in just five illegal transactions over the past two months, more than $8 million in damage has been inflicted on the country’s petrochemical industry. A loss that, according to informed sources, part of it has gone into the pockets of brokers and sanction profiteers and should be legally pursued. Now, if the extent of the damage inflicted on the overall urea market in Iran and the producers of this petrochemical product is calculated, we will certainly reach much larger numbers that are beyond imagination.

This report is exclusively prepared and organized by Iran Gate. Such content in Iran Gate is classified as a special case. You can view some other cases like the behind-the-scenes investigation of Mobarakeh Steel and decoding of Steel Gate, the Mobarakeh Steel corruption case in Isfahan.

DMCA Protected Cover Content