What have sanctions done to people’s livelihoods

Comparing banking transaction statistics and exchanged checks before the U.S. withdrawal from the JCPOA and the early months of this year clearly shows the impact of the return of sanctions on the livelihoods of Iranian households.

According to Irangate, inflation’s rampant presence in Iran’s economy has turned meeting the basic needs of life into a major challenge for many people. One of the most important causes of this inflation is the global sanctions against the Islamic Republic. Reviewing the daily expenses of people before and after the sanctions clearly shows the impact on household livelihoods.

Sanctions and their effect on people’s tables

In recent years, the impact of sanctions on Iranian households’ tables has been quite noticeable. After Iran’s nuclear agreement with the P5+1 countries, known as the JCPOA, the living conditions in the country improved significantly. During this time, people were able to breathe a sigh of relief with the lifting of sanctions, but this opportunity was short-lived due to the United States’ withdrawal from the JCPOA.

It was May 2018 when Donald Trump, the then-president of the United States, officially withdrew from the JCPOA, and the Islamic Republic faced increased sanction pressures once again. The impact of this event quickly became evident in people’s daily lives, making it harder for many Iranians to meet their basic needs, a situation that has persisted and even intensified to this day.

Although over the past year, the government of Ebrahim Raisi has repeatedly emphasized the failure of sanctions as a result of the government’s neutralizing actions, the evidence does not support this claim. An examination of official statistics not only fails to show the neutralization of sanctions but also indicates the worsening of living conditions for various segments of society.

What do banking transaction statistics say

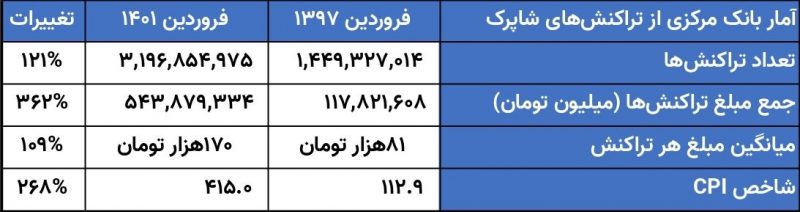

Official statistics released by the Central Bank indicate the direct and significant impact of the return of sanctions in 2018 on people’s daily expenses and, consequently, the shrinking of Iranian citizens’ tables. This issue has been examined by comparing people’s banking transactions at two different times: the first period being March 2018, before the U.S. withdrawal from the JCPOA, and the second period being March 2022.

According to these statistics, the total number of bank card transactions on the Shaparak network in March 2018 was about 1.45 billion transactions. This figure, with a 121% increase over four years, reached approximately 3.2 billion transactions. The increase in the number of transactions is a natural result of population growth and the penetration of electronic payments among people, but the noteworthy point in this comparison is the sharp increase in transaction amounts.

According to Central Bank statistics, in March 2018, the total transactions of bank cards amounted to more than 117 trillion tomans, but in March 2022, this figure exceeded 543 trillion tomans, reflecting a 362% increase in transaction amounts over just four years.

Meanwhile, according to Central Bank statistics, the inflation rate over these four years was 268%. On the other hand, calculations in the table below show that the average amount per bank transaction in March 2018 was 81,000 tomans, which more than doubled in March this year, reaching 170,000 tomans.

Spending more, buying less

To better understand these numbers, imagine an individual going to a store for daily shopping. In March 2018, this person could complete their purchase by paying 81,000 tomans, but now they must pay 170,000 tomans. The 268% inflation during this period indicates that this increase in payment is not due to an increase in purchase volume, but rather due to the runaway rise in prices.

In other words, it can be said that comparing the rate of increase in the average transaction amount in recent years with the living conditions suggests a noticeable lag in people’s purchasing power behind the inflationary jumps caused by the U.S. withdrawal from the JCPOA.

In fact, not only can the individual not make the same amount of purchases in 2022 with more than double their 2018 money, but the volume of their shopping basket has also significantly decreased. It should be noted that this review does not account for the recent sharp increase in the prices of essential goods, and the current situation is much more dire.

The JCPOA, a glimmer of hope for low-income groups

As mentioned in this report, the volume and number of banking transactions in the two referenced periods clearly indicate the severity of the situation at people’s tables. A situation that, in the past year, due to a sharp inflation surge and record-breaking point-to-point inflation in the thirteenth government, has made life more difficult for low-income and middle-class Iranians.

Of course, these statistics and figures are not the only evidence showing a meaningful connection between the quality of people’s livelihoods and the direction of the Islamic Republic’s foreign policies. However, reflection on such reports can more than ever prove the existence of a direct relationship between the quality of life of Iranian citizens and the government’s approach to the Islamic Republic of Iran’s nuclear file.

The latest news and reports related to the JCPOA can be found on the dedicated Iran Gate JCPOA negotiations page.