There is no loser but Iran

There is no loser but Iran. This is an analytical report on the JCPOA, while interactions between Iran and the United States over the final JCPOA agreement have reached the exchange of media statements by Iranian, American, and European officials following the end of the Vienna negotiations. Optimism about the full revival of the JCPOA has faded, at least in these days and the coming weeks. Many expected that an agreement would be reached after the first round of opinion exchanges between the two sides, and that there would be no serious disagreement preventing the signing of the text prepared by the European Union.

In the early days of September, optimism is tied to the coming weeks and not the early days of the next week. On one hand, American officials have explicitly emphasized their stance on maintaining the functionality of the JCPOA and the absence of any grounds or space for creating exceptions or undermining the expert control and inspection process of the International Atomic Energy Agency. On the other hand, there are key American officials who have shown hope in media talks for reaching an agreement.

John Kirby, the spokesperson for the US National Security Council, is one of the most important officials who, in an interview with the Saudi news network Al Arabiya, expressed hope for both sides reaching the final point of understanding and signing the agreement. Even in response to questions and criticisms from Saudi and Israeli critics of the JCPOA, he defended the lifting of sanctions imposed on Iran.

In the midst of media hustles by Iranian and American officials, experts and media activists occasionally remember the Russians. Ulyanov, Putin’s representative in Vienna, also with his acrobatic tweets, strikes a balance, and interestingly, this same Ulyanov shows the least sensitivity towards the dangerous actions of his country’s army in endangering the Zaporizhzhia nuclear plant, the largest nuclear plant in Europe, and comfortably directs his statements on this matter towards the political confrontation between the West and Russia.

Where have we reached in this story of interactions? Will Iran, after all these diverse struggles for not reaching an agreement, have a politically and economically secure future? Legal and regular access free from sanctions to the energy market for Iran will naturally not be possible without the JCPOA. What will be the fate of Iran’s economy, our country’s industries, and the oil and gas industry itself under sanction conditions? Two concrete subjects of the main winners of what happened before and what will happen in the absence of Iran in the JCPOA should be considered.

Russia, Saudi Arabia, and Trump

Donald Trump did not like the JCPOA because Obama’s name was on it. Apart from that, the animosity he showed towards the agreement with Iran should be placed alongside his eagerness to start negotiations with Iran for another agreement. Up to this point, everyone knows and we know, but why did the maximum pressure policy, which was apparently supposed to be a tool to convince Iran to such an agreement, find aspects that essentially removed the basis for agreement?

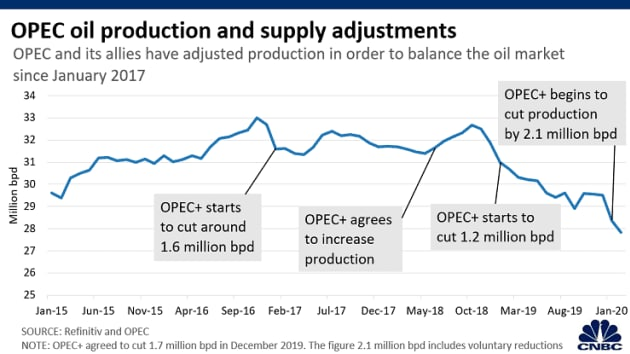

A scene from the winners’ game of Trump’s behavior with the JCPOA should be watched in the 2018 reports on the game of oil production and pricing by Russia and Saudi Arabia. Two years before Russia and Saudi Arabia, under the shadow of the Corona crisis and the disruption of countries’ economic cycles on one hand and the change in energy consumption equations on the other, marked one of the most historic oil battles. In the middle of 2018, and in a process finalized in the last months of that year, the two countries agreed to a creeping increase in their oil production.

This was at a time when with the start of the Trump administration’s program to limit Iran’s oil sales and pretending to bring it to zero, oil prices had been on the rise for a long time. Before Saudi Arabia and Russia reached such an agreement, the Russians had already broken all oil production and diverse oil product sales records in Russian and Soviet history in mid-2018.

Specifically, Newsweek reported that Saudi and Russian officials had agreed to pursue the policy of increasing production using the opportunity of Iran’s absence in the oil market and to roll in the expensive oil trade market decisively and without doubt and, of course, by pretending that the production increase was unrelated to the sanctions against Iran.

American oil companies also benefited from Iran’s sanction conditions. However, it was Saudi Arabia and Russia that became unmatched leaders in the market and were good oil allies until the Corona era and the oil battle between them. The damage inflicted on Iran’s economy was not compensated by Russia and naturally not by Saudi Arabia. Meanwhile, the blessing of high oil revenues for Saudi Arabia and Russia meant that they found the ground to develop and strengthen their oil industries.

Money brings more money, and maintaining and developing the oil industries of producer countries is a costly affair. Iran was the main loser in Trump’s game with the JCPOA, with the wear and tear inflicted on its oil industry and lost markets needing decades to recover, even if the sanctions are lifted.

Iran lost specific buyers, and one specific example was Sri Lanka, whose refineries and oil imports were set based on the specific quality and type of Iranian oil, and everything changed after Iran was sanctioned.

Russia, Saudi Arabia, and everyone

Russia, by invading Ukraine, overturned all energy market equations. Now cheap Russian oil is dominating the market, and various countries are officially and unofficially buyers of Russian oil. Even Saudi Arabia has made interesting purchases from Russian oil companies to supply oil for its power plants, which cannot be supplied from its own country’s oil production network. Various African countries are developing their oil production programs.

Angola, for example, is a country whose 2022 contracts and programs have been remarkable. Angola has been a significant oil seller to China, which is no longer a serious buyer of Iranian oil. Russia, in the current situation and naturally with political leverage and thanks to its related forces in Iran, has easily sidelined Iranian brokers selling Iranian oil who trade oil loads on the water.

It is natural that these Iranian brokers, who receive oil and trade it like street vendors on the water, are indebted to and grateful for the policy of resistance economy, which has only one concrete and executive directive: control of oil sales by the private sector. The current parliament, which has facilitated the delivery of oil to private sellers, i.e., brokers, with the presence of cheap Russian oil and the Russian stick over Iran, the sanction conditions, and Iran’s absence in the JCPOA, spells the death of Iran’s national oil industry, and the capital belonging to the people becomes cheaper and cheaper in the hands of brokers.

Apart from oil, the potential for Iran to sell gas to Europe is also practically disappearing. Special contracts with Azerbaijan, Israel, Algeria, and one or two other countries have been signed or are being signed, and Qatar’s gas purchase contracts and programs have long been finalized, and energy companies in countries like Italy, in addition to previously finalized programs, may also finalize new purchase plans from Qatar. Opportunities that are burning away.

The JCPOA is a structure for controlling Iran’s nuclear program. We previously said that this structure is operational, and the latest reports from the International Atomic Energy Agency on Iran’s nuclear activities have recorded the exact number and type of centrifuges operating at the underground Natanz facility. The JCPOA is working, and sanctioned Iran is absent in it and merely plays the role of being under control.

Sanctions are a blessing, and these blessings are for Russia, Saudi Arabia, and apparently everyone except the people of Iran. Even the Iranian regime will be a loser in the short term. An economy that is even dependent on the oil and gas industry needs serious income for the survival of that industry and the maintenance and development of its energy industries, which is not possible to achieve with sanctions.

What has been narrated here focused on the oil and gas industries, and we did not discuss issues like strategic metals. If it comes to that field and if we place all these alongside strategic discussions like attracting European industries and expanding European production lines within Iran, the burnt and burning opportunities will form an astonishing list. In our neighborhood, Turkey is dancing on the ashes of Iran’s burnt opportunities.

For the latest news related to the JCPOA nuclear agreement, visit the dedicated Iran Gate page named JCPOA negotiations.