Competition between China, the US, Congo, and Saudi Arabia

The competition between China, the US, Congo, and Saudi Arabia over minerals for electric vehicle production became evident when the Democrats’ new investment plan in the US economy and society was ready for approval. Everyone was surprised by the Senate Democrats’ consensus and unity on this plan. Senator Manchin, a Democrat, had long opposed the plan, but suddenly his support and approval came through. This plan, which was enthusiastically brought to President Joe Biden’s desk and signed, is called the Inflation Reduction Act, and contrary to its name, it is not expected to have a significant impact on inflation.

What is important in this plan are the achievements that are expected to be gained through extensive and historic US investment in various sectors to combat climate change. One of the major investment aspects of this plan in fighting climate change is the various supports for the development and use of electric vehicles in the US. Naturally, a significant part of this support will be directed towards the different production processes of such vehicles in America.

Electric vehicles are known to everyone by the name Tesla and Elon Musk. However, the production process of these vehicles involves intricacies and required components that have been the subject of the hottest economic and political competitions in recent months and will continue to make headlines in the coming months.

From Cobalt to Lithium

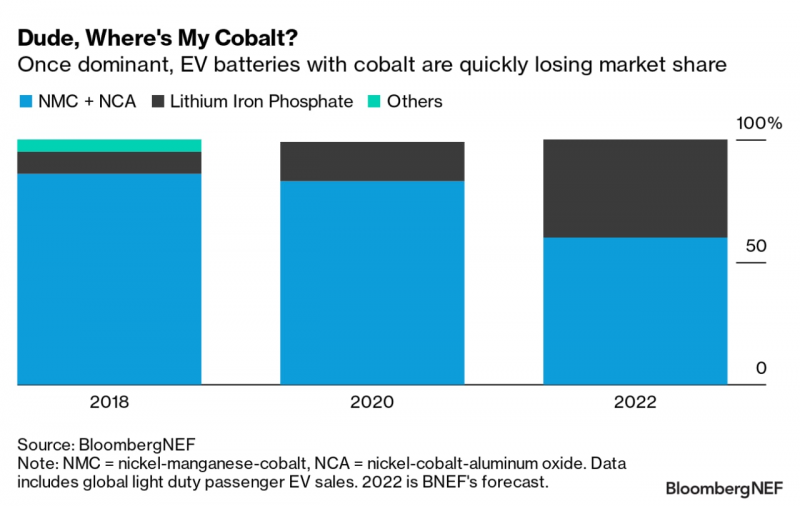

At the forefront of minerals used in electric vehicle batteries is cobalt. However, it should be noted that lithium has long been a key metal in the automotive industry in general, and now the next generation of electric vehicle batteries is set to rely on lithium instead of cobalt.

Currently, and for a few more years, cobalt, alongside lithium, is the heart of electric vehicles. These changes and innovations in various pathways are supported by the US government solely to support domestic industries and research. Interestingly, until we transition from cobalt to the newer generation lithium batteries, the production and processing of cobalt and other metals used for electric vehicles will benefit from financial support and investment from the US government based on the newly approved Democratic plan. This is only on the condition that the entire electric vehicle production process takes place in America and without reliance on countries of concern, namely Russia and, more importantly, China.

The strictest possible approach has been taken in the text of this plan for the production of electric vehicle batteries in America, and special and unusual conditions have been set to ensure that the maximum product is produced on American soil. Otherwise, there will be no financial support or tax exemption. Apart from the US, countries with free trade agreements with America can also be part of the process of supplying raw materials for the batteries.

These regulations and conditions, which were slightly patched and changed in the final text of Biden’s favored investment plan but were largely maintained, have specific points that will have a serious impact on the fate of the massive investment in electric vehicle production in America and the interactions in the coming months regarding the production of strategic metals. Specific countries like Argentina and Japan, which are players in the final production of metals like lithium, do not have direct free trade agreements with the US.

Beyond all this, and most importantly, the country of concern that the American production industry is set to confront with the overwhelming financial support of this plan is China, which dominates the cycle of cobalt and lithium production and supply. Although a significant portion of cobalt mines are specifically not in China or America, they are in Congo.

China scoops up cobalt in Congo

A percentage of the world’s exploitable and suitable cobalt resources are in Congo. At first glance, such a vast sea of wealth in an African country is not surprising. African countries are rich in plundered and being-plundered wealth. However, the absolute ruler of the cobalt production and distribution cycle, from extraction to processing, is China, which controls significant mines in Congo.

The company Tenke Fungurume Mining, a giant in China’s mining industry, has taken control of key cobalt mines in Congo. For several months, disputes between the Chinese, particularly this mining company and its main parent company, with the Congolese government and mining company have created serious sensitivity in African politics on one hand and serious discussions in the strategic metals market on the other.

Although the disputes and controversies between the two sides have somewhat subsided, and a better outlook for Chinese and Congolese cooperation is seen, it should be noted that the conflict between the Chinese company and the Congolese mining company had reached a point where the Congolese recently made every effort to fully take over the Chinese company active on their soil.

The months-long struggle between the two sides resulted from the Congolese becoming aware of Chinese falsehoods and incorrect statistics regarding Congo’s metal and mineral resources and reserves. China itself is seriously aware of the transitional period from cobalt to lithium in the production of electric vehicle batteries.

Bin Salman also wants electric vehicles

If there is a country that has amassed immense wealth from the burning of fossil fuels worldwide and the resulting air pollution, global warming, and climate change, it is Saudi Arabia. The largest oil producer in the world, with its massive refining facilities, owns the most profitable industrial giant in the world in 2022, Aramco.

Aramco, however, is simultaneously the most polluting industrial facility and the most dangerous for climate change in the world. The Saudis’ grand plan to expand the use of electric vehicles and to bring the percentage of these vehicles to 30% of all vehicles in the country in the near future is not solely based on purchasing vehicles produced outside Saudi Arabia. Of course, the Saudis’ electric vehicle purchase contracts are extensive, and for example, their contract with Lucid, in which they are shareholders, has been very attractive.

However, the Saudis’ special approach is not only in recent months but much longer than that, focused on production. Naturally, this idea may have been presented by foreign consultants and Western investors, but in any case, the Saudis have made extensive investments in expanding the extraction of a special strategic metal, which is lithium.

More than 150 requests for mining exploration in Saudi Arabia are under review. Several rounds of investment and financial support for foreign companies, especially Australian mining companies, have been made, which may, in the near future, bring the total value of these investments to $30 billion. Saudi Arabia is one of the countries that may soon become a new hub for the production of strategic metals for electric vehicles and their batteries.